Technology

Chart: The Coin Universe Keeps Expanding

Chart: The Coin Universe Keeps Expanding

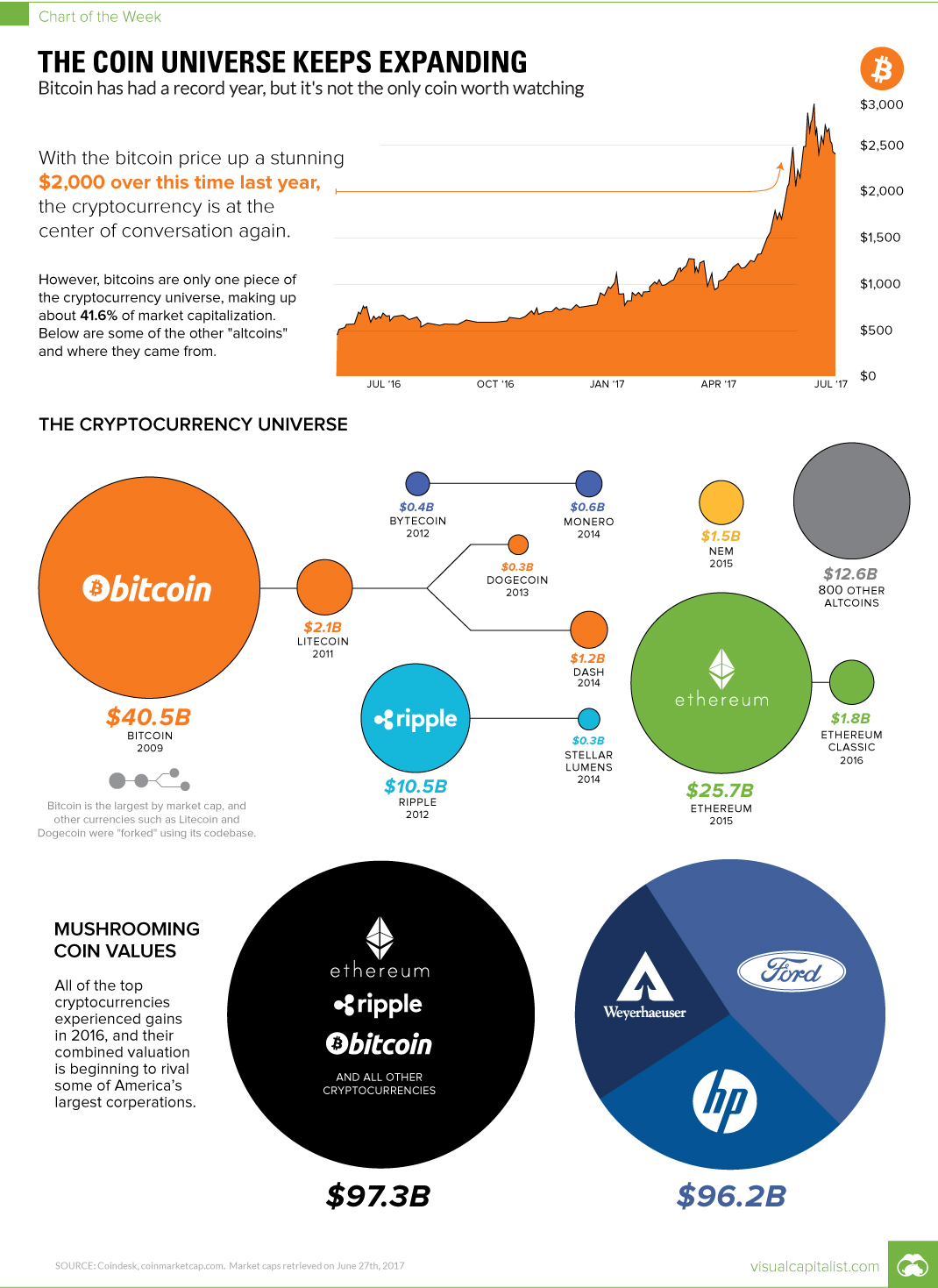

Bitcoin’s record year is just a part of the big story

Note: This post was updated June 27th, 2017 with current values for all cryptocurrencies.

Bitcoin is the original cryptocurrency, and its meteoric rise has made it a mainstay of conversation for investors, media, and technologists alike.

In fact, the innovation of the blockchain is changing entire markets, while causing ripples with central banks and the financial industry. At time of publication, the bitcoin price now hovers near US$2,400, a massive increase from this time last year.

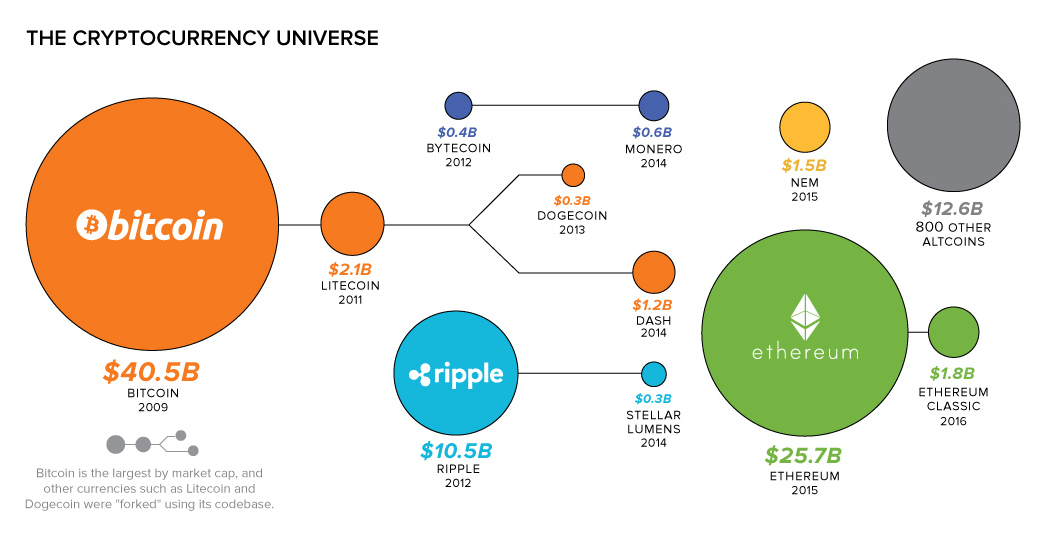

But the true impact of Bitcoin is actually far more reaching than this – it’s actually helped to birth new markets for over 800 other cryptocurrencies and assets that are available for online trading. And while the market for bitcoins is worth $40 billion itself, the rest of these cryptocurrencies are actually worth even more in combination.

The Altcoin Universe

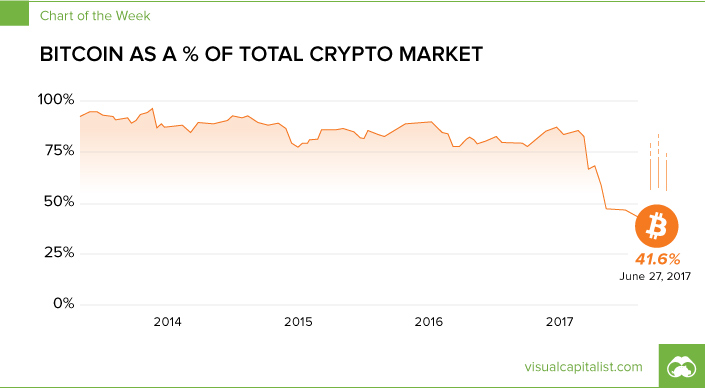

For the first time since Bitcoin was founded, it now makes up the minority of the entire cryptocurrency market at about 41.6% of all coins and assets.

So what are the other altcoins that make up the rest of this universe, and where did they come from?

Litecoin

Litecoin is one of the first altcoins, and it is nearly identical to Bitcoin after being “forked” in 2011. Litecoin aims to process blocks 4x faster than Bitcoin to speed up transaction confirmation time, though this creates several other challenges as well. At time of writing, Litecoin’s market capitalization is worth $2.1 billion.

Ethereum

Ethereum, launched in 2015, is the largest coin by market capitalization aside from Bitcoin. However, it is also quite different. While Bitcoin is designed to be a payments protocol first, Ethereum enables developers to build and deploy decentralized applications, while also enabling smart contracts. The tokens used to power the network are called Ether, but they can also be traded online. At time of writing, Ethereum’s market capitalization is $25.7 billion.

Also interesting: the Ethereum network actually split into two in 2016. It’s a complicated situation, but read about it here. There is now a separate Ethereum, based on the original Ethereum blockchain, trading as “Ethereum Classic” with its own market capitalization of $1.8 billion.

Ripple

Ripple (XRP) is the native currency of the Ripple Protocol – a broader catch-all for an open-source, global exchange. It’s already being used by banks such as Santander, Bank of America Merrill Lynch, UBS, and RBC. It solves a different problem than Bitcoin, allowing for settling payments between different currencies and even different payment systems. Today, Ripple’s native coin (XRP) has a market cap of $10.5 billion.

Learn More

With over 800+ altcoins or assets out there, there’s plenty of information to absorb.

Here’s a short 20-minute course on the history of altcoins that might provide useful context, as well as in-depth explanations of Ethereum and Ripple that may help you learn about the important parts of a rapidly growing altcoin universe.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024